CVC Board Members & Board Observers

About the Program

Today’s Corporate Venture Capitalists (CVCs) are playing increasingly influential and high-value roles in the global investment ecosystem, participating in more than 25% of VC deals. However, CVC is a challenging job. Corporate Venturing programs must operate professionally in a complex set of interdependent ecosystems involving both internal and external stakeholders and are tasked with both financial and unique strategic mandates. Integrating an understanding of the VC ‘rules of the game,’ with an appreciation for the nuances and requirements of strategic investing is fundamental to CV program professionalism and impact.

What is CVC Board Members & Board Observers?

This is the definitive course on CVC Board Member and Board Observer strategies and best practices:

Delivered via a fast-paced combination of lectures, challenging hands-on scenario role plays and interactive discussions with CVC, VC and legal experts, and cohort peers

Explores the roles, responsibilities and global considerations for venture-backed company Board Members and Board Observers

Describes the regulatory and contractual framework for startup company Board Members and Board Observers and outlines typical board meeting agenda and practices

Delves into the nuances for strategic investors serving as startup Board Members and Board Observers (e.g. Board Member vs Board Observer strategies, Board Member vs Stockholder representative roles, side letters, corporate vs personal liability and reputational risk…)

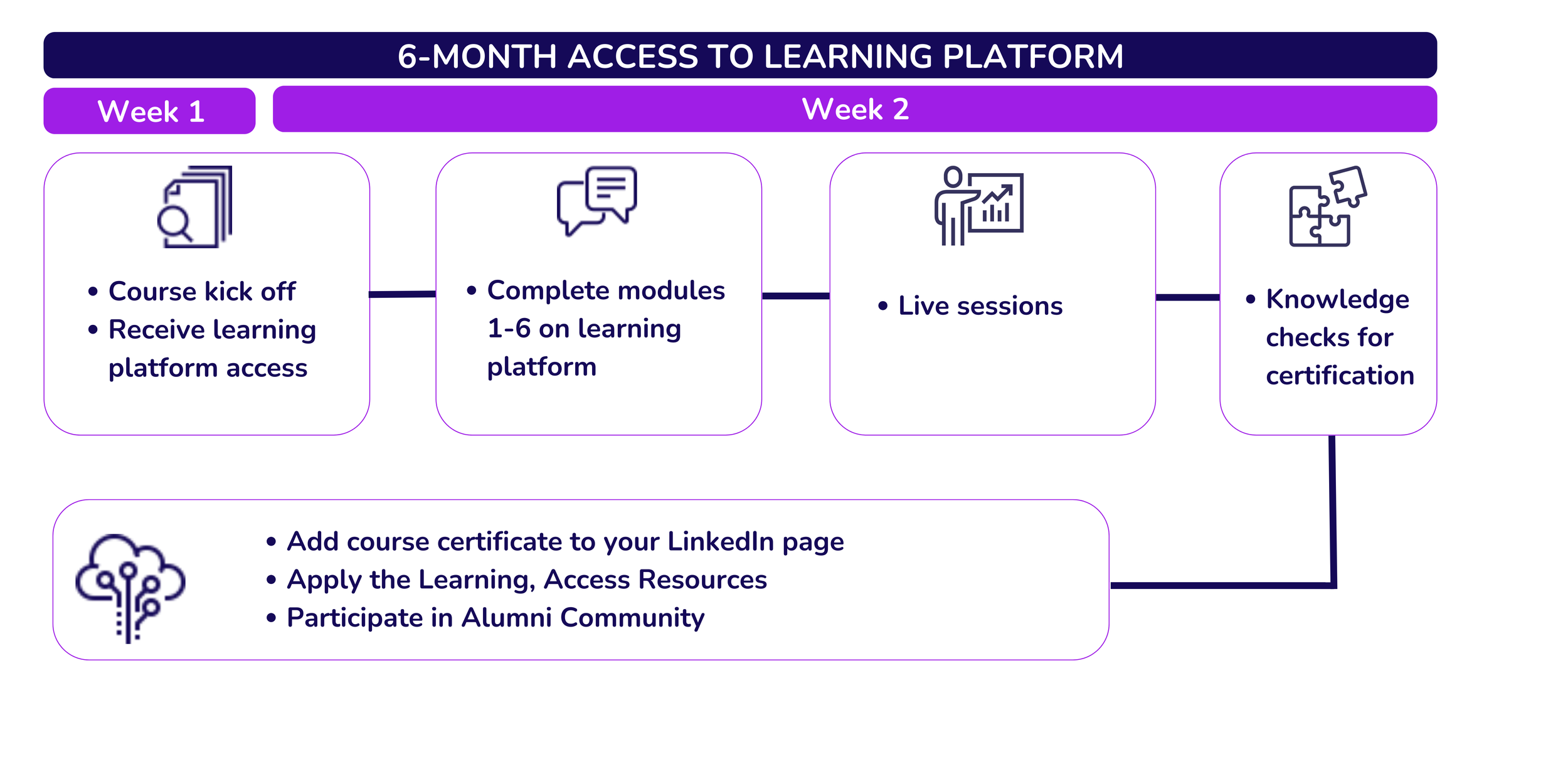

Includes library of resources, assessment-based certification framework and ongoing update/re-certification process to ensure team knowledge and skillset remain current

Offers ongoing access to private Institute alumni LinkedIn group and quarterly online expert panels discussing CVC hot topics

Course Format Benefits

CVC Board Members & Board Observers is offered in two formats: live online (via Zoom) or in person, each with unique benefits. The course content is the same in both formats, with the exception of an additional legal expert panel where US and European attorneys will compare and contrast the treatment of fiduciary duties in Delaware vs key European jurisdictions.

Our live online courses offer:

Flexibility and Convenience: Accommodate your professional and personal commitments with a course structure designed for 6 hours over two days.

Immediate Application of Skills: Apply what you learn in real-time to your current role and team, boosting your productivity and contributing to your organization’s success.

Comfortable Learning Environment: Study from the comfort of your work, home, or preferred location with easy access via an online Zoom link.

Cost Effective: Save on travel and accommodation costs while still accessing high-quality training.

Networking Opportunities: Connect with peers from other corporations to share experiences, challenges, and best practices

Our in person courses offer:

Networking Opportunities: Interact face-to-face with industry experts and fellow participants

Interactive Learning: Engage and ask questions in real time and participate in discussions that will enhance your learning to the full.

Hands-on Experience: Deepen your understanding and retention of the material through practical exercises and case study discussions.

Amplify Effectiveness and Impact

Our in-person conduct runs across two full days, while the live online conduct runs across three days (four hours per day).

-

Legal framework (structure, governance and committees,

applicable laws)Role of the Board and fundamental duties

Board composition

-

Duty of Care

Duty of Loyalty

Business Judgement Rule

Safe Harbors and good Board Member practices

Director and Stockholder roles

Legal representations and protections

US States and International variances of Fiduciary responsibilities

-

Meeting logistics, quorum and structure

Preparing for the Board meeting

Nuances for CVC Board Members

-

Serving on audit or compensation committees

Dealing with down rounds or insolvency

Preparing for exits/M&A

Handling CEO/key executive transitions

Stockholder situations

Transitioning Board Member

Portfolio company policies

-

Observer rights and responsibilities (contractual)

What makes a good Observer

CEO and VC expectations of CVC Board Observers

Confidentiality and Conflicts of Interest

The Side Letter

-

Board Seat vs. Board Observer Seat: Pros and cons

BU representatives as portfolio company Board Members or Observers

Transfer of an existing CVC Board Seat/Observer Role

Learning Modules

Upcoming Conducts

April 20-22, 2026

7 AM - 11:00 AM PT

This course is held live online and include a kick off session on April 13th, 2026 from 8AM-9AM PT.

Who Should Attend?

New or aspiring CVC portfolio company Board Members or Board Observers

Experienced CVC Board Members or Board Observers in need of a ‘refresher’

CVC Investors, who share portfolio company investment management responsibilities with Business Unit executives who hold the Board Member or Board Observer seats

Business Unit executives who are or aspire to be CVC portfolio company Board Member or Board Observers

In-house legal counsel who work with the CVC team

Community

Enrollment in CVC Board Members & Board Observers include invitations to quarterly panel discussions featuring a VC, a CVC and an attorney.

Pricing

$2,500 per person for live online course delivery or $3,500 per person for in person course delivery.

Group discounts and Leadership Society member discounts available – contact courses@gcvinstitute.com for more information.